S&P 500 clinches first record close of 2025, Dow pops after Trump takes spotlight at Davos

Homebuyers backed out of deals at record rate in December

Deals to purchase a home fell through at a record rate in December as high mortgage rates and housing costs caused buyers to lose faith.

Nearly 40,000 home purchase agreements were canceled in December, equal to 16.2% of homes that went under contract that month — the highest percentage of any December on record, according to Redfin.

House hunters are having trouble committing because housing costs remain expensive. According to Freddie Mac, mortgage rates have moved higher over the past six weeks, but this week the average 30-year fixed mortgage rate fell 8 basis points to 6.96% from 7.04%.

“Homebuyers pumped the brakes when mortgage rates ticked back up, and are now in wait-and-see mode,” Jesse Landin, a Redfin real estate agent in San Antonio, said in the Redfin report. “Everyone is just trying to figure out when rates are going to come down again. In the meantime, a lot of house hunters are opting to rent.”

Buyer appetite “will likely slow further in January due to the wildfires impacting Los Angeles — the nation’s second most populous metro area — and winter storms impacting the Mid-Atlantic and Southeast,” Redfin senior economist Elijah de la Campa said in the report.

Related Posts

Trump can meet Canada and Mexico ‘in the middle’ on trees, lutnick says

At the Form COUTESE AROUND REALESE, one manager who is successful, in the morning in the morning, says (BLK: NYSE)

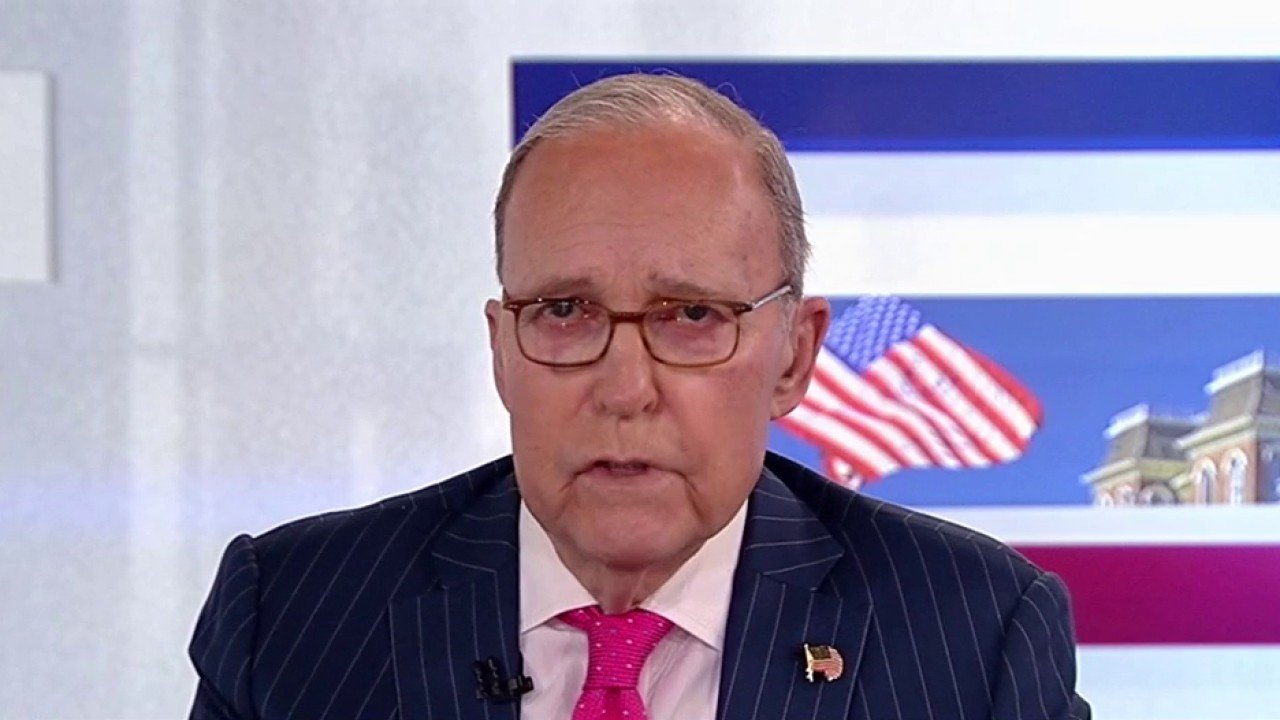

Larry Kudllow: Darryrs of taxes, cheating with software discussion

Larry Khadlow: and ‘Russia, Russia, Russia’ – But Financial

Billioire Musek says they are not interested in finding a taktok